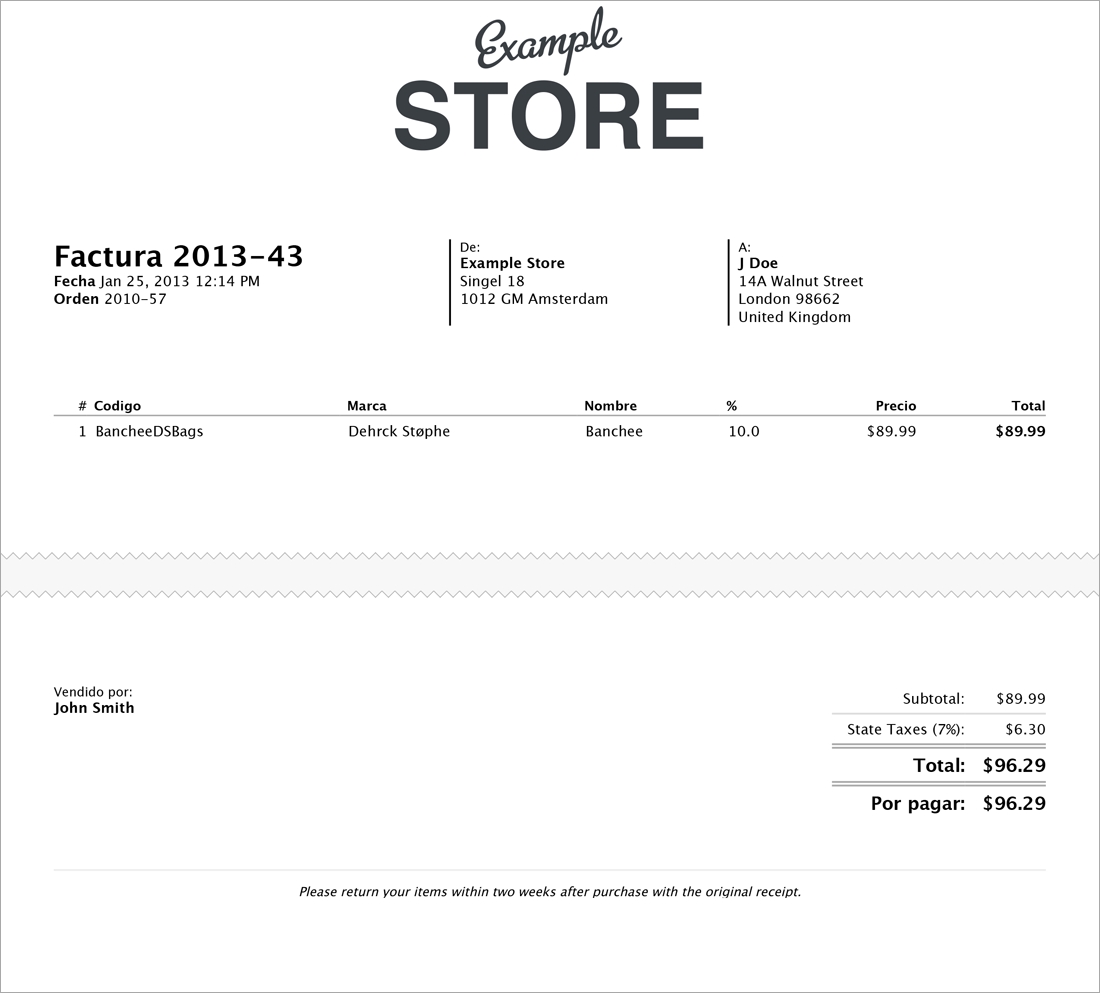

It must contain at least the word invoice (“Factura” in Spanish), the invoice number, the date, the seller’s and buyer’s details, the VAT number, the description of the items, the total amount and the VAT details. What data should an invoice contain?Īn invoice from Spain has certain requirements regarding its content. These and other obligations and the short presentation time make it even more necessary to understand perfectly what information is contained in a Spanish invoice. As a general rule, invoices must be submitted to the Tax Authority (Agencia Tributaria) within four days.

Spanish law establishes a series of obligations in relation to invoices, including the obligation to emit and submit them for commercial or professional transactions, the obligation to keep a copy of each invoice or the obligation to book all invoices, both emitted and received. In Klippa we have processed already many invoices and we keep doing it, and that is why in this blog we can explain to you where to find the information you need in a Spanish invoice.

INVOICE IN SPANISH HOW TO

This is because each country has its own invoice format, so there are no common rules on how to make an invoice. In addition, if the company operates in an international context, it will have to deal with foreign invoices that can be difficult to understand. As a consumer, you may not handle invoices often, but companies do.

0 kommentar(er)

0 kommentar(er)